Beyond the Bright Lights: Unearthing Real Estate Gold in Second-Tier Markets for Savvy Investors

Uncover Real Estate Gold in Second Tier Real Estate Markets : In the relentless pursuit of lucrative real estate investments, many often fixate on the dazzling allure of first-tier markets – the bustling metropolises with their towering skyscrapers and constant influx of capital. While these major cities undoubtedly hold their own appeal, a growing number of astute investors are turning their gaze towards a less crowded, yet equally promising landscape: second-tier markets. These smaller cities and towns, often overlooked in favor of their more glamorous counterparts, are increasingly revealing themselves as fertile ground for affordable real estate opportunities with significant potential for growth and attractive returns.

For too long, the narrative of real estate investment has been dominated by the allure of prime locations in major urban centers. The promise of high appreciation and consistent tenant demand can be intoxicating. However, this intense focus has often led to inflated prices, fierce competition, and compressed profit margins, particularly for individual investors or those with more modest capital. It’s time to broaden our horizons and recognize the untapped potential that lies within the often-underestimated realm of second-tier markets.

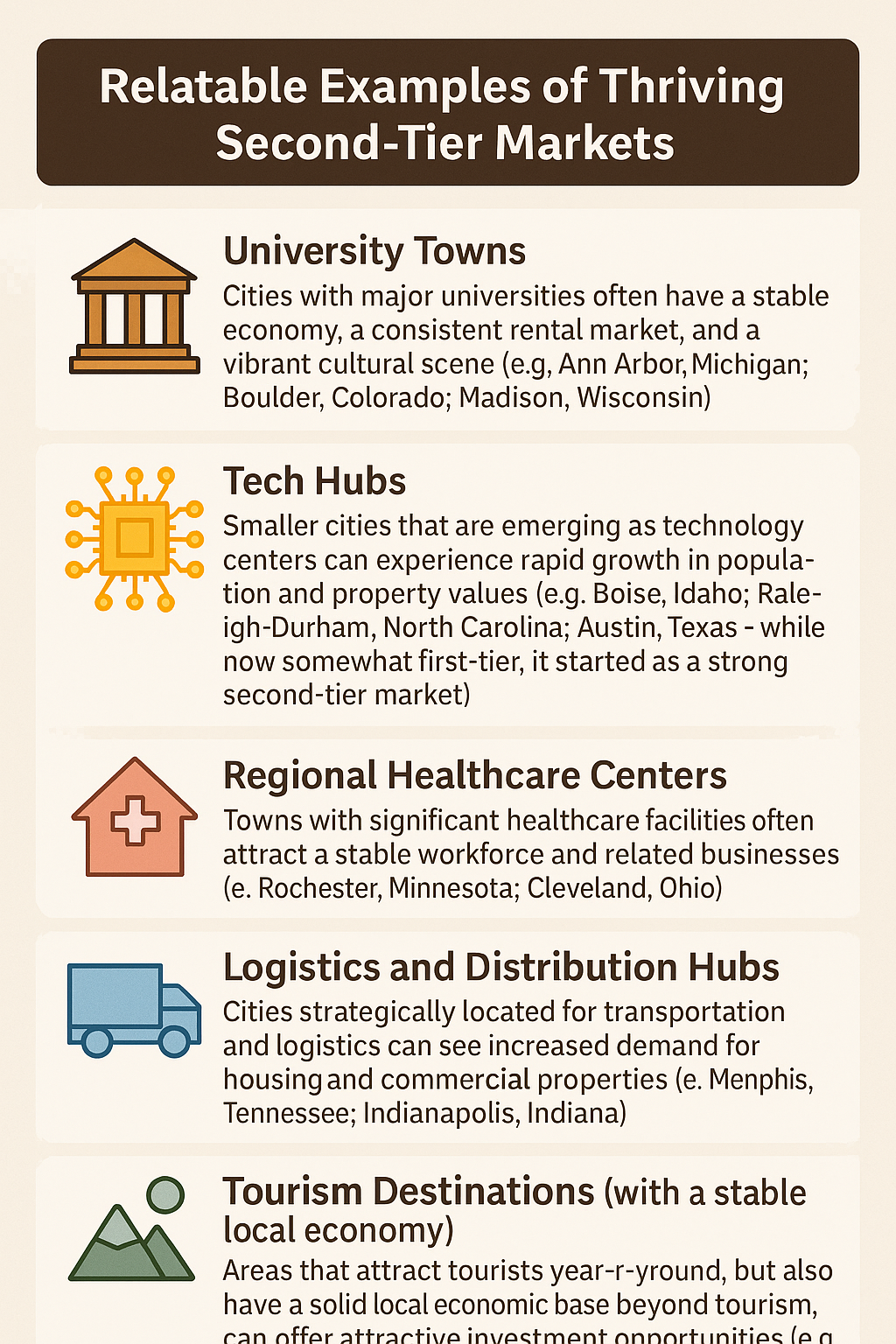

What exactly constitutes a “second-tier market”? These are typically cities and larger towns that possess a stable economic base, a growing or steady population, and a quality of life that is attracting residents and businesses, but which haven’t yet reached the hyper-competitive and often overvalued status of major metropolitan areas. Think of places with established universities, burgeoning tech hubs, significant manufacturing presence, or a strong tourism sector – locations that offer a blend of affordability and genuine growth drivers.

The shift towards second-tier markets isn’t just a contrarian strategy; it’s a response to a confluence of economic and demographic trends that are making these locations increasingly attractive

The Compelling Case for Second-Tier Market Investments

- Affordability is King: This is perhaps the most significant draw. Real estate in smaller cities and towns is often significantly more affordable than in major urban centers. This lower barrier to entry allows investors with limited capital to acquire properties, potentially diversify their portfolios more effectively, and achieve better cash flow due to lower mortgage payments and property taxes relative to rental income.

- Stronger Cash Flow Potential: Lower acquisition costs directly translate to the potential for higher rental yields. While rents might not be as astronomically high as in New York or San Francisco, the ratio of rent to property value is often more favorable in second-tier markets, leading to healthier and more consistent cash flow for investors.

- Less Intense Competition: The reduced spotlight on these markets means less competition from large institutional investors and seasoned players. This provides individual investors with a greater opportunity to find undervalued properties and negotiate favorable deals. You’re less likely to be in a bidding war against deep-pocketed corporations.

- Genuine Growth Drivers: Many second-tier markets are experiencing organic growth driven by factors like the relocation of businesses seeking lower operating costs, the expansion of regional universities attracting talent, the development of specialized industries, and an increasing desire for a better work-life balance among residents seeking an escape from the pressures of major cities.

- Improving Quality of Life: Smaller cities and towns often boast a higher quality of life with less traffic congestion, lower crime rates, more green spaces, and a stronger sense of community. This can be a significant draw for both renters and homeowners, leading to stable occupancy rates and long-term appreciation.

- Potential for Appreciation: While appreciation in second-tier markets might not mirror the rapid spikes seen in booming first-tier cities, it can be more sustainable and less prone to dramatic bubbles. As these markets continue to attract residents and businesses, property values are likely to steadily increase over time.

- Untapped Potential and Early Entry Advantage: Investing in a second-tier market before it fully comes onto the radar of mainstream investors can provide a significant “early mover” advantage. As these markets gain recognition and experience growth, those who invested early stand to reap substantial rewards.

Navigating the Potential Pitfalls

While second-tier markets offer significant advantages, it’s crucial to be aware of potential challenges:

- Slower Appreciation (Potentially): While appreciation can be steady, it might not match the rapid growth seen in some first-tier markets, especially during boom cycles. Investors need to have a longer-term perspective.

- Less Liquidity: Selling properties in smaller markets might take longer than in major urban centers with a larger pool of potential buyers.

- Economic Sensitivity: Smaller economies can sometimes be more vulnerable to downturns in specific industries. Thorough economic diversification analysis is crucial.

- Limited Tenant Pool (in some very small towns): While demand can be strong in growing second-tier cities, very small towns might have a more limited pool of potential tenants.

- Need for Local Expertise: Understanding the nuances of the local market is paramount. Building relationships with local real estate agents, property managers, and other professionals is essential.

Advice for Exploring Second-Tier Market Investments

- Broaden Your Search: Don’t limit your property searches to major cities. Actively research smaller cities and towns that exhibit the growth drivers mentioned earlier.

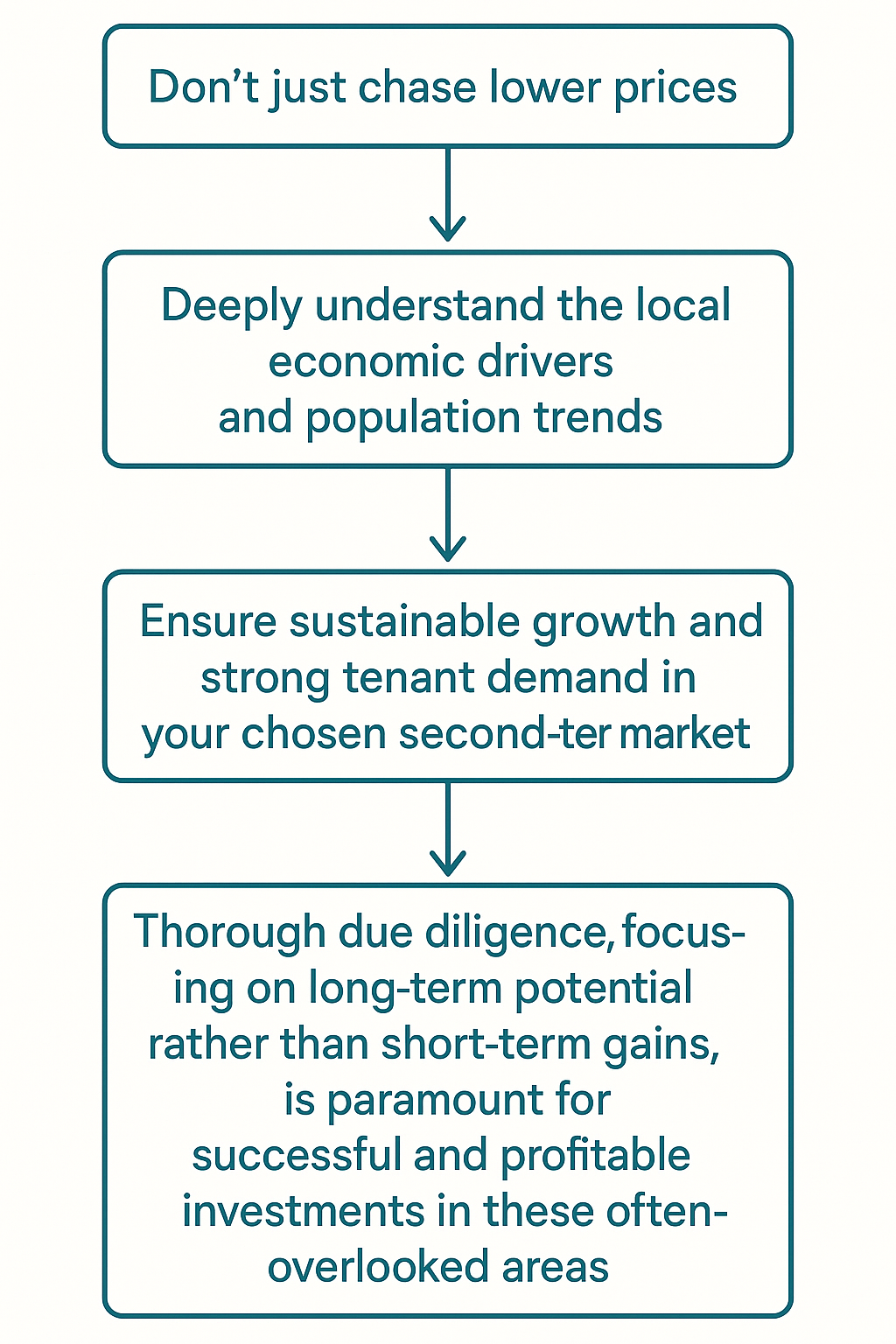

- Conduct Thorough Due Diligence: Don’t skip any steps in your research. Analyze economic data, population trends, infrastructure plans, and local market dynamics.

- Network Locally: Connect with real estate professionals, local business owners, and community leaders in your target markets to gain valuable insights.

- Visit Potential Markets: Spend time in the cities and towns you are considering. Get a feel for the local atmosphere, amenities, and quality of life.

- Start Small (If Necessary): If you’re new to second-tier markets, consider starting with a smaller investment, such as a single-family rental property, to gain experience.

- Focus on Cash Flow: Given the affordability advantage, prioritize properties with strong cash flow potential.

- Consider Long-Term Holds: Second-tier market investments often yield the best returns over the long term as these areas continue to grow and mature.

- Partner with Local Property Management: A good local property management company can be invaluable in navigating the nuances of the rental market and managing your properties effectively.

A Personal Reflection: I remember a conversation with a seasoned investor who had built a successful portfolio by focusing on overlooked towns around a growing regional university. While others were chasing expensive properties in the nearest major city, he quietly acquired several well-located rentals that consistently generated strong cash flow and appreciated steadily as the university expanded. His success story highlighted the power of looking beyond the obvious.

Are you ready to explore the exciting potential of second-tier market investments? Start your research today! Identify a few smaller cities or towns that pique your interest based on the factors discussed. Dive into their local economies, population trends, and real estate markets. Share your initial findings and any questions you have in the comments below. Let’s unlock the hidden gems of the real estate world together! The next lucrative investment opportunity might just be waiting for you in a town you’ve never considered before.

news via inbox

Keep up with everything happening by following MyTimeOfLife